In this resource

Strengthen your processes and increase data-driven decision-making for faster study start-ups.

Strengthen your processes and increase data-driven decision-making for faster study start-ups.

Creating a new product is an arduous, but super exciting journey that involves creativity, innovation, brainstorming, extensive research, but also a fair amount of drama and frustration. An excellent example is the journey of the new module in Clinical Maestro VISION for “service provider capability assessment.” It is at the last stages of design and finalization of the requirements, as I write this article.

There are so many use cases targeted for the application: new vendor identification, service categorization, profile de-risking, capability assessment at the service level and functional qualification (not to be interpreted as QA driven GXP qualification). The problems we are trying to solve have never been tackled in a comprehensive manner and are costing the industry >$10B a year, according to industry surveys.

The Current Challenges in Vendor Management

Identifying, onboarding, and qualifying fit-for-purpose service providers for clinical trial management involves deciphering a myriad of service descriptions and crossing multiple service categories each with different risk levels and assessment needs. The industry is not prepared to efficiently manage this level of complexity.

Take a recent example we were part of as service providers. We were bidding on a large project that involves multiple Clinical Maestro modules: PORTOFOLIO, for clinical trial planning and budgeting, SOURCE for clinical outsourcing management and R&D procurement, and VISION, for vendor performance management. The Sponsor’s use cases span across multiple departments and user groups, such as Vendor Quality, Alliance Management, Procurement, Outsourcing, Clinical Operations, and Finance. IT group is a key stakeholder, guarding the types of systems that are admitted into the organization, the technology ecosystem, and the integrations roadmap. The evaluation is competitive with several large SaaS providers, all “generic solutions,” except for Clinical Maestro, intended to be customized for purpose. The original vendor selection and onboarding timeline is planned for 1 month and is led by Procurement/Outsourcing.

We won the bid, but when looking retrospectively at the actual selection and onboarding process, it took six months, not one; throughout the journey we have interacted with more than 15 potential users and engaged a dozen stakeholders on our side; we have completed 8 distinct Excel questionnaires, responded to 300+ questions and completed 2 online surveys.

Collectively, we spent >250 hours; the Sponsor, who evaluated >4 potential solutions, invested much more, designing the questionnaires, reading and comparing the vendor responses in Excel, consolidating all responses across multiple RFIs and online surveys, defining risk parameters, scoring each vendor individually and aggregating scores at vendor level and across all vendors, managing multiple internal stakeholders and project managing the entire capability evaluation and vendor selection - all done manually, no automation.

Easily over 1200 hours were spent in vendor capability assessment across multiple categories, onboarding and selection and this excludes contracting; overall the cost of the capability evaluation exceeds $250,000- by conservative estimates.

How Vision Helps

Vision’s new module significantly streamlines the complex process of vendor capability assessment, onboarding, and qualification. By integrating multiple functionalities into a single platform, VISION provides a comprehensive tool that reduces the time and resources required for these tasks. This module automates many of the manual steps previously described, including questionnaire distribution, response collection, and the analysis and scoring of vendors.

With VISION, companies can configure the system to adapt to various service categories and tailor the questions and evaluation criteria specifically to their needs. This customization extends to the aggregation of scores and creation of summary dashboards that help decision-makers quickly understand vendor performance and make informed choices. The result is a dramatically shortened onboarding process, from months to weeks, and a substantial reduction in the costs associated with vendor evaluations.

Innovations in Clinical Trial Vendor Onboarding

Can the industry truly afford this level of expenditure across thousands of vendor selections and capability evaluations that biopharmaceutical companies embark on every year?

Many pharma companies and established companies in general have attempted to reduce the expenditure by adopting a preferred vendor program; while there is no denying that reducing the portfolio of vendors to onboard significantly reduces the cost of capability evaluations, best practices require category refreshing, qualification maintenance as well as preferred program reassessment based on performance metrics. With the rapid pace of technology adoption in clinical trials and the emergence of digital innovation offices, new service categories are popping up at an accelerated pace, for example- the unique nuances surrounding DCT and the suite of decentralized clinical trial technologies. Shutting down the gate to new vendors is also toxic to innovation that stems from start-ups and leveraging next-generation AI/ML backed solution.

Early on in our commercialization journey, when we were not getting “traction” into large organizations, I was told that “Nobody gets fired for hiring Oracle”. Yes, I guess this is true, but now I came to understand that the real gatekeeper is not the size and maturity of the organization, but the effort and the cost that it takes to embark on new vendor service category evaluation, onboarding, and qualification.

So, what should you expect out of VISION’s new module, in light of the current state of the industry? Simply, the most comprehensive SaaS solution in the market to tackle the complex challenge of new vendor capability assessments for clinical trials. We have looked closely at the competitive space, and we found that even the most prominent procurement and qualification solutions lack the specificity pharma needs for clinical trial service category processes and risk evaluations.

Vendor quality, vendor management, clinical outsourcing, and R&D procurement users logging into VISION will find a completely configurable solution that allows defining multiple categories per vendor, customizing questions and surveys by category and function, project managing internal stakeholders with intuitive, easy-to-set-up workflows, scoring capabilities that extend from question-specific to criteria-focused scoring and score weighting, instant scoring aggregations and decision-making dashboards.

Vision Cuts Onboarding Costs for Service Providers by Up to 95% Compared to Traditional Methods

We estimate that the cost of onboarding will be reduced by as high as 95% vs. the status quo using VISION, while profoundly shortening qualification timelines and increasing user satisfaction.

I have never been more excited about the clinical outsourcing profession than now; the next generation SaaS applications, such as Clinical Maestro, are making R&D procurement fun. Instead of being buried in Excel and frustrating old technology, the outsourcing managers now have “superpowers” that allow them to elegantly navigate the complex challenges of outsourcing. Yes, it’s pharma, so we need many baby steps; it starts with standardization, easy-to-use tools, fit-for-purpose solutions.

In this resource

Strengthen your processes and increase data-driven decision-making for faster study start-ups.

RESOURCES

Explore Expert Insights and Resources for Clinical Excellence

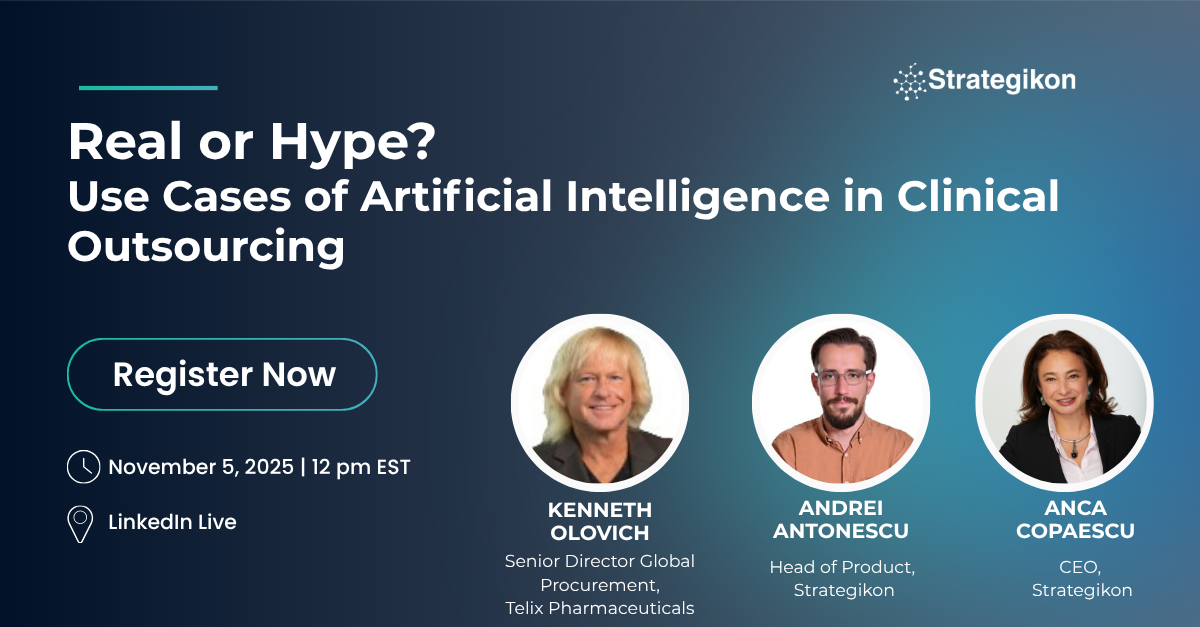

Webinars

AI is everywhere these days — but it’s also confusing. What exactly is it? Does it actually work? Why do some companies restrict its use? Are all “AI” tools created equal? And how do generative and agentic AI differ? Join Clinical Maestro’s live webinar to cut through the noise and explore what’s real vs. hype in AI for clinical outsourcing and procurement.

Blogs

Strategikon launches Clinical Maestro® 5.0 with Clinical Maestro AI — transforming clinical outsourcing. Learn how sponsors and CROs benefit from vendor intelligence, rate card compliance, change order simplification, and cost transparency.

Case Studies

Faced with inefficiencies, compliance risks, and fragmented communication, a biopharma company dramatically enhanced its vendor governance by implementing VISION!

DEMO

Request a demo

Discover how Strategikon’s advanced solutions can streamline your clinical trial operations. Request a personalized demo to explore how our tools transform budgeting, vendor management, and outsourcing efficiency for pharma and biotech.